By Manav Midha ’19, Contributor

The 2008 subprime mortgage crisis hurt America on a scale not known since the Great Depression itself. The bursting of the housing bubble and subsequent devaluation of securities and liquidity crisis certainly hurt the rich—but they made their money back and in the years following.

Lower and middle class Americans were hurt the most by the housing bubble collapse. With immense amounts of funds available to them, the big conglomerated banks of Wall Street bought and sold sub-prime mortgages (loans to risky clients with low credit ratings) and collaterized debt obligations (baskets of loans). When large numbers of these loans started defaulting, cash began to evaporate from banks’ holdings.

Suddenly, banks had only close to 10% of their assets under management, the minimum required under fractional reserve banking. A liquidity crisis emerged: when people realized that banks were in the red financially they quickly began knocking on bank doors, asking for their hard-earned money back…but the money had vaporized.

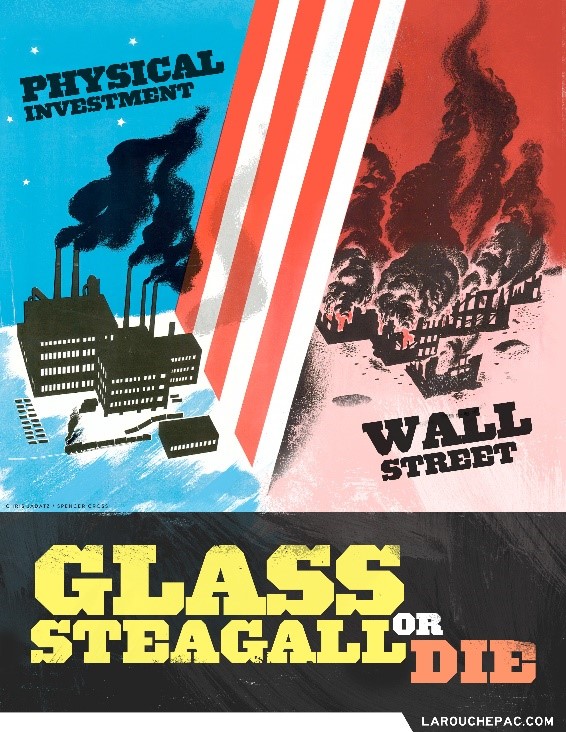

If America wants stability, security, and safety in its financial system the answer is simple—reinstate the Glass-Steagall Act. This separates investment and commercial banks.

Reestablishment of the act benefits everyone. Investment banks can be free to invest (gamble) however they want, with limited restrictions and commercial banks can focus on securely holding client money and loaning money to prime sources. Fractional reserve banking will still be able to function but it will be a safer system, with a higher fraction of assets being required to stay within the bank. Each business can focus on their specialty, making more efficient companies. The average American can keep their hard-earned money in a bank without worry of the bank losing that money on a glorified bet. Reinstatement benefits the American people!

Commercial banks have their purpose: to hold people’s cash, make small interest payments, give safe loans to strong clients, and earn a steady, safe profit. Investment banks also have their reason for being. They streamline the M&A (merger-and-acquisition) process, underwrite inter-business transactions, and value and model finances of companies,. They also provide some liquidity to the financial system as a by-product of their actions and make riskier, potentially more profitable loans to subprime clients.

Arguing that the complexity of modern financial systems is so intense that separating investment and commercial banks would be unfeasible is simple accepting “too big to fail.”American taxpayers spent $700 billion bailing out the banks!

In 1998, commercial bank Citicorp merged with insurance company Traveler’s Corp (which also owned investment bank Smith Barney), forming conglomerated bank Citigroup, the largest financial institution known to mankind at the time. It had insurance services, commercial and investment banking services under its realm and over two trillion dollars in assets under management.

This illegal merger led to intense lobbying and eventually the repealing of Glass-Steagall, the adhesive which had glued an economy for 65 years since its inception. In 1999 under the Graham-Leach-Bliley Act president Bill Clinton officially withdrew from our laws a financial act that lead to the greatest period of economic growth in human history. Only nine years later, Citigroup imploded from its risky investments of client cash without their knowledge, requiring a $45 billion bailout by the federal government. Citigroup was deemed “too big to fail”… and that is disgusting.

Repealing the Glass-Steagall Act will lead to a more stable, secure, and safe financial system, and will bring liberty and prosperity to all.

Sources: http://www.gpo.gov/fdsys/pkg/PLAW-106publ102/html/PLAW-106publ102.htm

http://fortune.com/2013/09/10/government-banks-15-billion-on-citigroup-bailout/

http://www.pbs.org/wnet/need-to-know/economy/the-true-cost-of-the-bank-bailout/3309/

https://www.minneapolisfed.org/research/economic-policy-papers/liquidity-crises

Image Source: